Your Guide to First South Checking Accounts

Managing your everyday finances starts with the right checking account. At First South Financial, we offer a full suite of checking options—personal, business, youth, and high-yield—designed to fit your lifestyle, your financial goals, and your need for convenience. Whether you’re looking to simplify daily spending, maximize your savings potential, or streamline your business operations, there’s a First South checking account for you.

What Is a Checking Account?

Think of a checking account as your financial command center. It’s the central hub for your daily money activities—whether you're paying rent, shopping online, transferring funds, or receiving direct deposits. A checking account gives you fast, flexible, and secure access to your funds, anytime and anywhere.

Unlike savings accounts, which are designed to help your money grow over time, checking accounts are built for everyday transactions. Many people use them as their main spending account because of the ease of access through debit cards, mobile apps, ATMs, and online banking. Some checking accounts even offer interest on your balance, allowing you to earn while you spend. With a checking account from First South Financial, you’ll have the tools you need to stay on top of your finances with ease and confidence.

Why Open a Checking Account?

Opening a checking account is one of the smartest steps you can take for your financial well-being. Not only does it provide a secure place to keep your money, but it also offers the flexibility and convenience you need to manage your day-to-day finances. With a checking account, you can:

- Protect your funds with NCUA insurance up to $250,000, giving you peace of mind knowing your money is safe.

- Make everyday spending easier by using your debit card or mobile wallet to pay for groceries, gas, online purchases, and more—no need to carry large amounts of cash.

- Stay in control of your finances with access to online and mobile banking tools that let you track spending, pay bills, and set up alerts to help you stick to your budget.

You can also set up direct deposit to get paid faster and avoid unnecessary trips to a branch. And when it comes to bill pay, checking accounts allow you to schedule recurring payments—so you never miss a due date. Whether you're sending money to friends, paying rent, or managing subscriptions, a checking account keeps everything running smoothly and securely.

Types of Checking Accounts

No two financial situations are the same, which is why First South Financial offers a variety of checking account options tailored to your needs. Whether you're just starting out, looking to earn interest, or managing your business finances, there's an account for you.

Free Everyday Checking

If you’re looking for a simple, low-maintenance account for everyday spending, our free checking options offer maximum convenience with no monthly service fees (when minimum balance requirements are met). These accounts provide debit card access, ATM availability, online banking, and more—without the surprise charges.

Account Options:

- Standard Checking – No-fee account with basic features when minimum balance is maintained

- @nywhere Checking – A fully digital account with online and mobile tools built in

- Savings Plus Checking – Combines spending convenience with modest interest earnings

- High Yield Checking – Offers premium interest when used as your primary checking account

- Student & Youth Checking – Always free and ideal for those learning how to manage money

Best for: Members who want easy, everyday access to their funds with no or low fees

Interest-Bearing Checking

These accounts let you earn interest on your checking balance, giving you the benefit of liquidity while still seeing a return on your deposits. Great for those who keep higher balances and want a checking account that works harder for them.

Account Options:

- High Yield Checking – Earns market-leading interest rates when used as your main, active-use account

- Standard Checking – Earns modest interest with no monthly fees when minimum balance is maintained

- Savings Plus Checking – Offers interest and includes features of both checking and savings

- Student Checking – Designed for college students, this account earns interest while helping you manage day-to-day spending with ease

Best for: Members who maintain higher balances and want to earn interest without locking up their funds

Click below to learn more about our High-Yield Checking account:

Money Market Checking

For those who want to keep significant balances liquid while earning higher returns, our Money Market Checking combines the best of checking and savings. With tiered interest rates that increase with your balance, it’s an excellent option for short-term savings or emergency funds.

Account Option:

- Money Market Checking – Offers premium interest on higher balances; $2,500 minimum to avoid fees

Best for: Members who want high liquidity with superior interest rates on larger balances

Business Checking

Our business checking accounts are designed to simplify financial management for companies of all sizes—from local startups to established nonprofits and commercial entities. With features like online banking, debit cards, and no or low fees, managing cash flow has never been easier.

Account Options:

- Business Checking – Ideal for smaller operations with basic transaction needs

- Business Money Market – Earns premium interest on higher balances while maintaining liquidity; ideal for businesses looking to grow their excess operating funds

Best for: Business owners and nonprofit leaders who need streamlined, scalable banking solutions

Student & Youth Checking

These accounts are perfect for teens, college students, or anyone new to banking. With no fees and full mobile banking access, they provide a safe, simple way to learn money management and gain financial independence.

Account Options:

- Student Checking – Designed for college students age 18–24, this account offers interest earnings, no monthly service fees, and includes mobile banking, debit card access, and direct deposit

- Youth Checking – Tailored for teens age 13–17 with a parent or guardian joint owner. This free account includes a debit card, mobile access, and spending controls to help teach smart habits early

Best for: Young members starting their financial journey with guidance, flexibility, and modern tools

Joint Checking

Whether you're sharing finances with a partner, family member, or roommate, joint checking accounts help keep shared expenses organized. Each account holder receives a debit card and has equal access, making it easy to manage bills, groceries, or savings goals together.

Account Option:

Any First South checking account can be opened as a joint account

Best for: Couples, roommates, or family members managing shared financial responsibilities

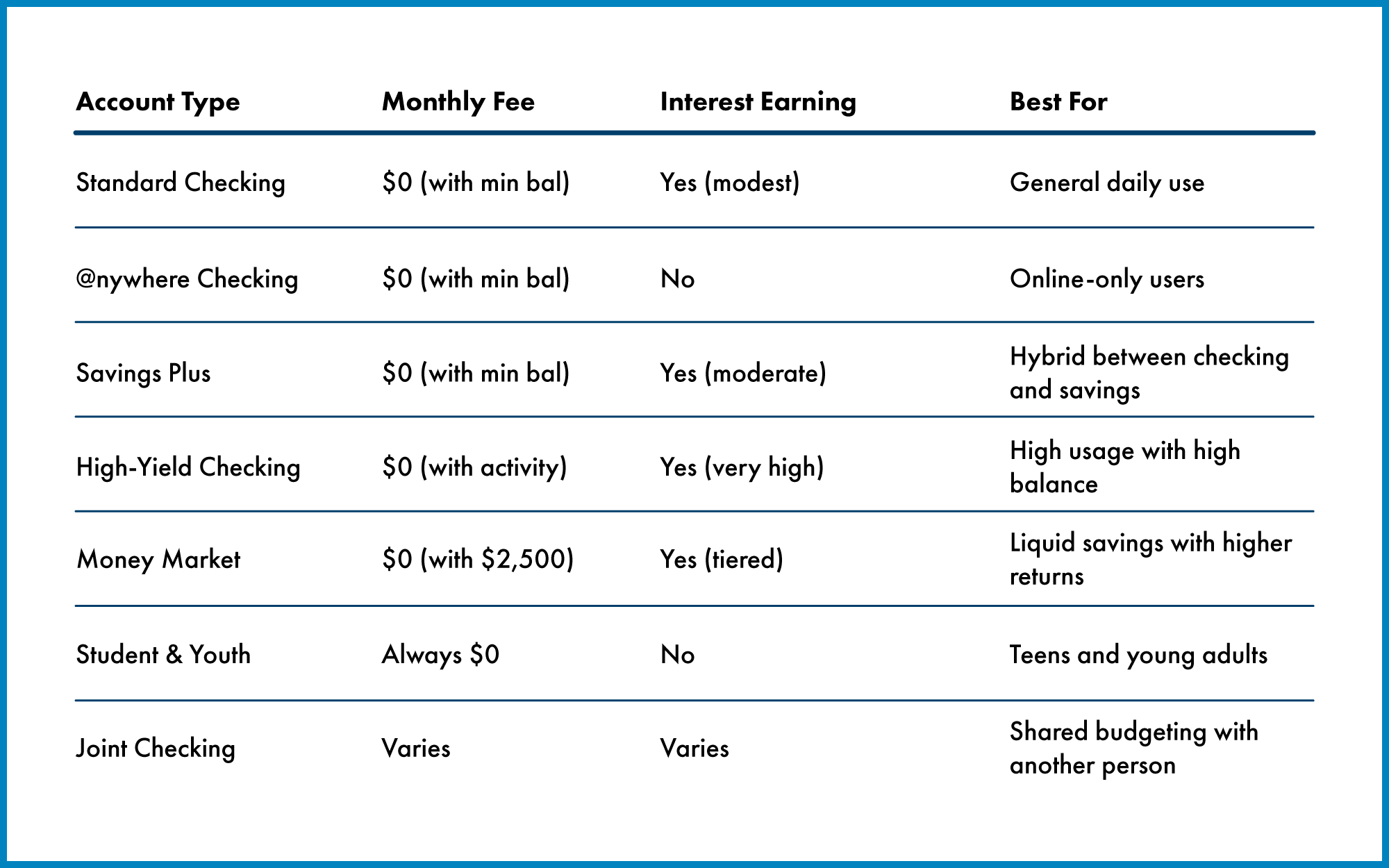

Quick Product Comparison

How to Open a Checking Account

Opening a checking account is fast, simple, and can be done entirely online. Just visit firstsouth.com/checking-accounts or stop by any First South Financial location with your:

- Government-issued ID

- Social Security number

- Proof of address

Our team will help you find the account that’s right for you and get you started on your financial journey.

Ready to open your new checking account?

Explore your options and apply today at firstsouth.com/checking-accounts or visit your nearest First South Financial Banking Center.

« Return to "Blog"