How to Protect Your Identity with Security Freezes and Credit Locks

In today’s digital world, identity theft and credit fraud are growing threats that can compromise your financial well-being. Fortunately, there are proactive steps you can take to protect your credit information—and two of the most powerful tools are security freezes and credit locks.

While these terms are often used interchangeably, there are important differences between them. At First South Financial, we believe in equipping our members with the knowledge they need to make informed financial decisions. Here’s a breakdown of what security freezes and credit locks are, how they differ, and when to use each one.

What Is a Security Freeze?

Also known as a credit freeze, a security freeze restricts access to your credit report. This means that lenders, credit card companies, and other third parties cannot view your credit report unless you lift the freeze, making it extremely difficult for identity thieves to open new accounts in your name.

Key Features of a Security Freeze:

- Free to place and remove with all three major credit bureaus: Equifax, Experian, and TransUnion

- Must be set individually at each bureau

- Prevents new credit applications from being processed

- Does not affect your credit score or current credit accounts

- Can be temporarily lifted or permanently removed using a secure PIN or online account

When to Use a Security Freeze:

- After discovering identity theft or a data breach

- If you don’t plan to apply for new credit in the near future

- When you want maximum legal protection over your credit file

What Is a Credit Lock?

A credit lock also restricts access to your credit report, but it’s typically offered as part of a service—either free or for a monthly fee—through each credit bureau. Unlike a freeze, which is governed by federal law, a credit lock is a product, and the terms can vary by provider.

Key Features of a Credit Lock:

- Typically managed via mobile apps or online dashboards

- Offers real-time control—you can lock or unlock your credit in seconds

- May include additional features such as credit monitoring, alerts, or identity theft insurance (depending on the provider)

- Still requires setup with each bureau individually

- May come with a cost for premium services

When to Use a Credit Lock:

- If you want more flexibility and ease of use

- For those who frequently apply for credit or loans and want quick access

- As part of a broader identity protection plan or credit monitoring package

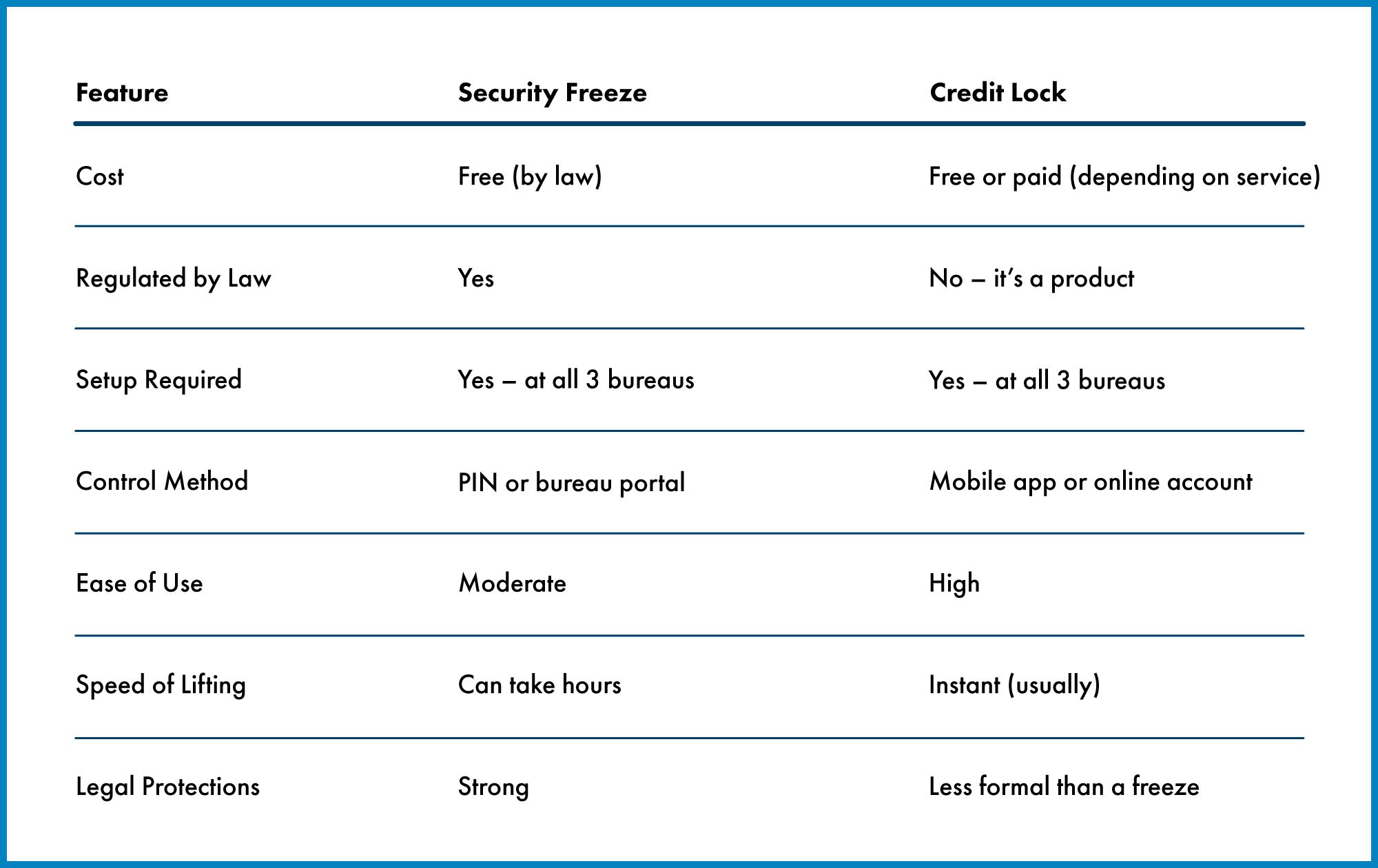

Security Freeze vs. Credit Lock: What’s the Difference?

How to Set Up a Freeze or Lock

You’ll need to create an account with each credit bureau:

- Freeze or Lock

- Freeze or Lock

- Freeze or Lock

Which Option Is Right for You?

Choosing between a security freeze and a credit lock depends on your personal needs and preferences.

- Choose a Freeze if you want no-cost, legally protected control over your credit.

- Choose a Lock if you prioritize speed and convenience, and you’re comfortable using digital tools.

In many cases, individuals may even use both in different circumstances—for example, freezing credit with one bureau and using a lock on another where you have premium identity protection services.

Protecting Your Financial Future

Identity protection is an important part of maintaining your financial health. While First South Financial monitors and secures our members’ accounts with advanced security measures, adding an extra layer of protection at the credit bureau level can further safeguard your financial future.

And don’t forget: starting healthy financial habits early can also reduce your risk. If you have a teen or young adult at home, now’s a great time to help them open a Youth Savings Account and begin learning responsible money management—including how to protect their identity from day one.

Still have questions?

Contact a First South Financial representative today to learn more about protecting your credit and how our tools and services can support your financial wellness.

« Return to "Friends & Finances"