HELOC or Personal Loan: Which Is Right for You?

When it comes to covering major expenses — such as home renovations, consolidating debt, medical bills, or even funding a big event — you might be wondering which borrowing option is right for you. Two popular choices are a Home Equity Line of Credit (HELOC) and a Personal Loan. While both can help you access the funds you need, they differ in structure, cost, flexibility, and risk.

At First South Financial Credit Union, we want to help you make an informed decision that aligns with your financial goals and comfort level.

What Is a HELOC?

A Home Equity Line of Credit (HELOC) is a revolving credit line secured by the equity you’ve built in your home. It works much like a credit card — you’re approved for a maximum credit limit and can borrow from it as needed during a draw period, typically lasting 5 to 10 years.

Key Features of a HELOC:

- Credit Limit: Based on your home’s appraised value minus your remaining mortgage balance.

- Draw Period: During this time, you can withdraw funds as needed.

- Repayment Period: Once the draw period ends, you begin repaying the principal plus interest.

- Variable Interest Rate: Your rate may fluctuate over time based on market conditions.

- Collateral: Your home secures the loan, which typically allows for lower interest rates.

What You Can Use a HELOC For:

- Home improvements and renovations

- Education expenses

- Emergency repairs or medical bills

- Debt consolidation

- Ongoing or unpredictable expenses (e.g., multiple home projects over time)

Pros:

- Lower interest rates than unsecured loans

- Potentially tax-deductible interest (consult a tax advisor)

- Flexibility to borrow only what you need, when you need it

- Reusable line of credit

Cons:

- Your home is at risk if you default

- Payments may increase due to variable rates

- May include closing costs and fees

Learn more about our HELOC options

What Is a Personal Loan?

A personal loan is a lump-sum loan that’s typically unsecured — meaning no collateral is required. You receive the funds all at once and repay the loan over a fixed term, with consistent monthly payments.

Key Features of a Personal Loan:

- Fixed Loan Amount: You borrow a specific sum upfront.

- Fixed Term: Repayment periods generally range from 12 to 60 months.

- Fixed Interest Rate: Your rate and monthly payment stay the same throughout the life of the loan.

- No Collateral: You don’t need to put your home or other assets at risk.

What You Can Use a Personal Loan For:

- Debt consolidation

- Medical expenses

- Travel, weddings, or large purchases

- Emergency repairs

- Short-term financial gaps

Pros:

- Predictable monthly payments and fixed interest

- Fast application and funding process

- No risk to your home or property

- Accessible even if you don’t own a home

Cons:

- Higher interest rates than secured loans like HELOCs

- Typically lower loan limits

- Interest is not tax-deductible

Explore our personal loan options

Which Is Better for You?

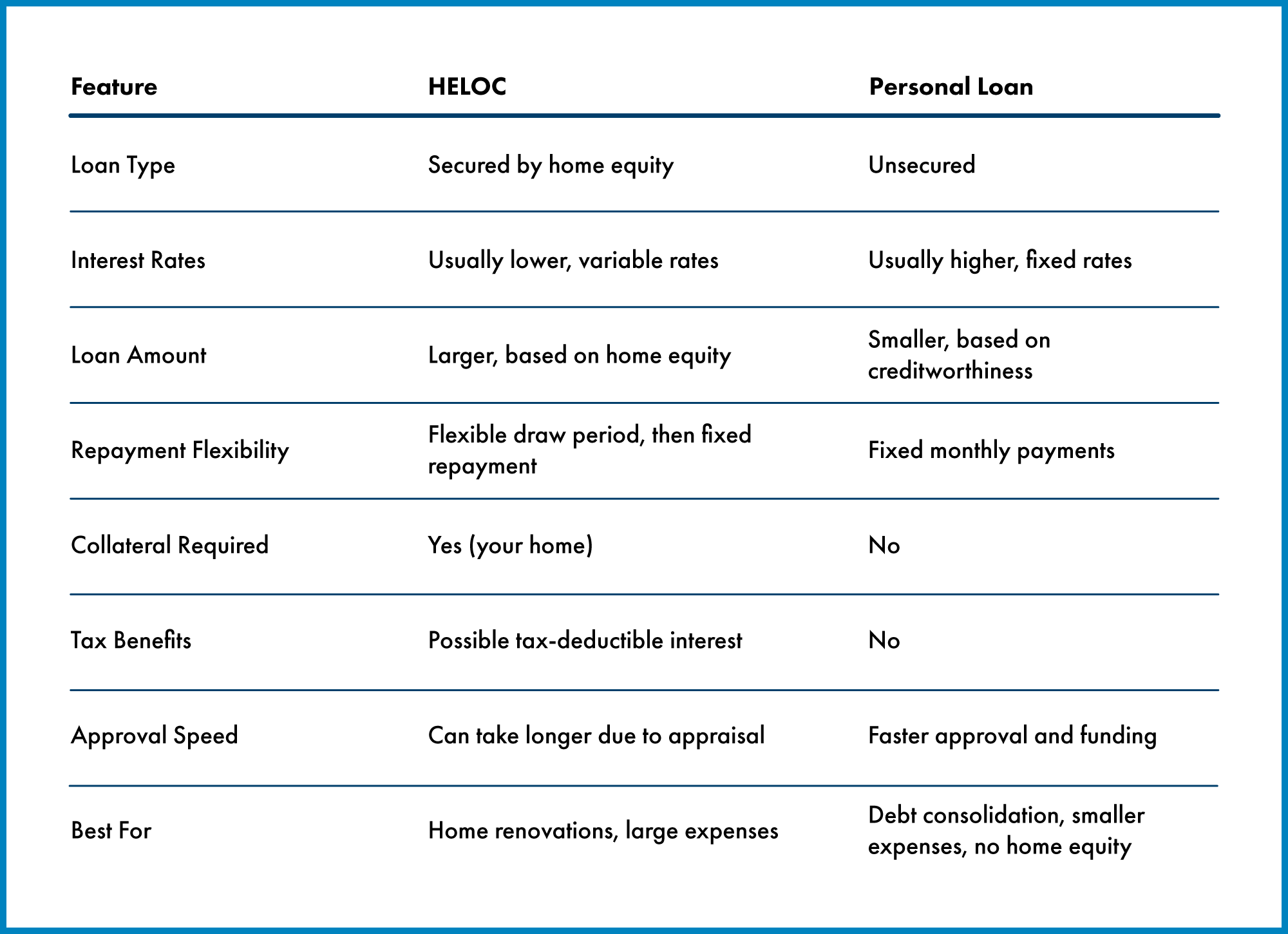

Choosing between a HELOC and a personal loan depends largely on your financial situation, borrowing needs, and risk tolerance. Here are some factors to consider:

Choose a HELOC if:

- You have significant equity in your home

- You want access to a larger credit line

- You prefer the flexibility to borrow multiple times over several years

- You’re comfortable with variable interest rates and using your home as collateral

HELOCs are ideal for:

- Large or phased home improvement projects

- Covering costs over time (e.g., tuition each semester)

- Consolidating high-interest debt with lower-rate financing

Choose a Personal Loan if:

- You need a fixed amount of money upfront

- You don’t want to use your home as collateral

- You want a predictable repayment schedule

- You need money quickly

Personal loans are ideal for:

- Debt consolidation

- Emergency expenses

- Smaller or one-time purchases

- Borrowers without home equity

How First South Financial Can Help

At First South Financial, we offer both HELOCs and personal loans with competitive rates and flexible terms. Whether you’re looking for a one-time lump sum or revolving credit backed by your home, our team is here to guide you every step of the way.

Let us help you choose the option that best fits your needs and budget.

Final Thoughts

Both HELOCs and personal loans offer practical ways to access the funds you need — but they serve different purposes. A HELOC gives you flexible access to your home’s equity over time, while a personal loan offers stability and speed with no collateral required. Understanding how each works can help you borrow wisely and confidently.

Ready to explore your options?

Visit our HELOC page or learn more about personal loans to get started today.

« Return to "Friends & Finances"