Auto Financing: Credit Union or Dealership?

Whether you're buying your first car, upgrading your vehicle, or refinancing an existing loan, how you choose to finance can make a big impact on your long-term financial health. Dealerships may offer convenience—but credit unions, like First South Financial, are built to serve your best interest.

Let’s break down the key differences and explore why more buyers are turning to credit unions for auto financing.

1. Lower Interest Rates That Save You More

One of the biggest advantages of credit union financing is access to lower interest rates. Because credit unions are not-for-profit institutions, earnings are returned to members through better rates and fewer fees—not used to increase profits like many dealerships or traditional lenders.

Why This Matters:

- A 1–2% difference in interest rate can save you hundreds or even thousands over the life of the loan.

- Credit unions like First South typically have no hidden markups, while dealers may inflate rates to earn extra commission.

- Lower rates mean lower monthly payments, making your car more affordable.

View today’s rates and see how much you can save with First South: firstsouth.com/auto-loans

2. Pre-Approval = Power and Protection

Before stepping onto the lot, get pre-approved for your auto loan. This step offers both financial clarity and negotiation power.

What Pre-Approval Does for You:

- Sets a clear budget, helping you avoid overspending or being upsold by dealers.

- Speeds up the buying process—you're essentially shopping like a cash buyer.

- Shields you from high-pressure sales tactics and financing gimmicks at the dealership.

With pre-approval from First South Financial, you’ll know how much you can afford, what your payments will be, and you’ll be able to focus on the car—not the loan terms.

3. Flexible Loan Terms That Fit Your Life

Dealership financing often pushes rigid loan structures or focuses only on short-term benefits. Credit unions, however, offer flexible repayment options that align with your needs and financial goals.

At First South Financial, you can:

- Choose terms from 24 to 84 months

- Refinance an existing loan to reduce your payment or interest rate

- Enjoy no prepayment penalties if you want to pay off early

Want to know what your payment might look like? Use our online calculators or speak with a loan officer for personalized guidance.

4. Transparent Fees & Optional Protection Products

One of the more frustrating parts of dealership financing is the surprise fees and bundled add-ons that appear in the fine print. These can include unnecessary warranties or overpriced protection packages.

How First South is Different:

- No application fees and minimal loan origination costs

- Optional protection products like:

- GAP coverage (covers the difference if your car is totaled and you owe more than it’s worth)

- Mechanical Repair Coverage to protect against expensive breakdowns

- Clear terms explained by people who are there to help—not sell

We believe in helping you make smart, informed decisions that fit your lifestyle and budget.

5. Personalized Service, Every Step of the Way

Dealerships are focused on volume and closing the sale quickly. Credit unions focus on building long-term relationships. At First South Financial, you’re not just a loan number—you’re a member.

What You Can Expect:

- Dedicated local support from people who know your community

- Access to financial education tools to help you manage debt and improve your credit

- Quick decisions and friendly service, whether you're applying online or in-branch

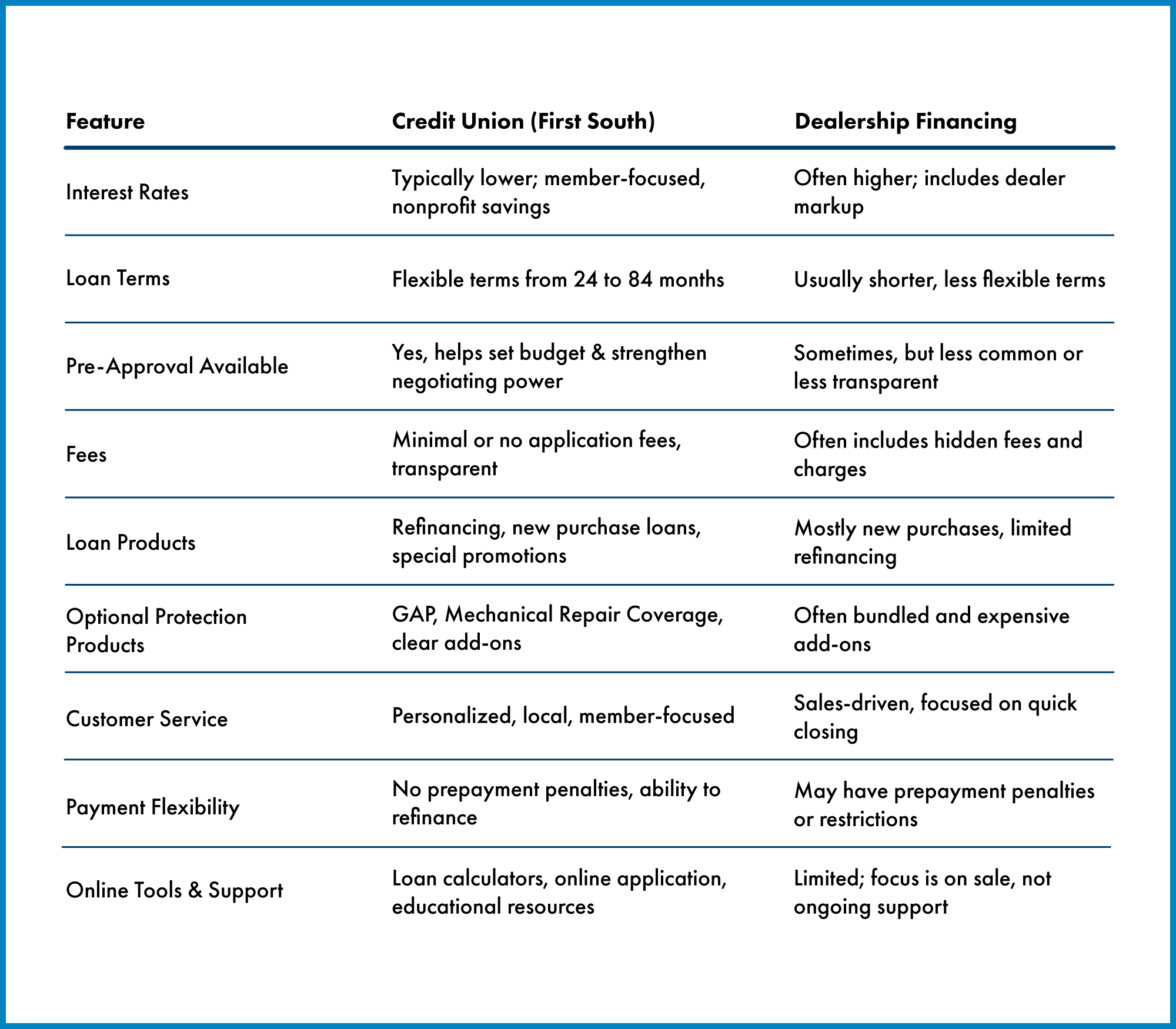

Comparison Chart: Credit Union Financing vs. Dealership Financing

Bonus: Exclusive Auto Loan Promotions

Credit unions frequently offer limited-time auto loan promotions, including:

- Rate discounts for automatic payments or loan protection

- Cashback incentives

- Special rates for new graduates or first-time buyers

Check out the latest auto loan specials: https://www.firstsouth.com/loans/auto-loans/auto-loan-specials

Final Thoughts

When comparing dealership financing vs. credit union financing, the numbers—and the experience—speak for themselves. Credit unions offer better rates, more flexible terms, lower fees, and trusted member-first service.

If you're ready to buy a car or refinance ?your current loan, get pre-approved with First South Financial. We’ll help you drive away confident—not just in your new vehicle, but in the financing behind it.

Apply online, explore rates, or talk with a loan expert today: firstsouth.com/auto-loans

« Return to "Friends & Finances"