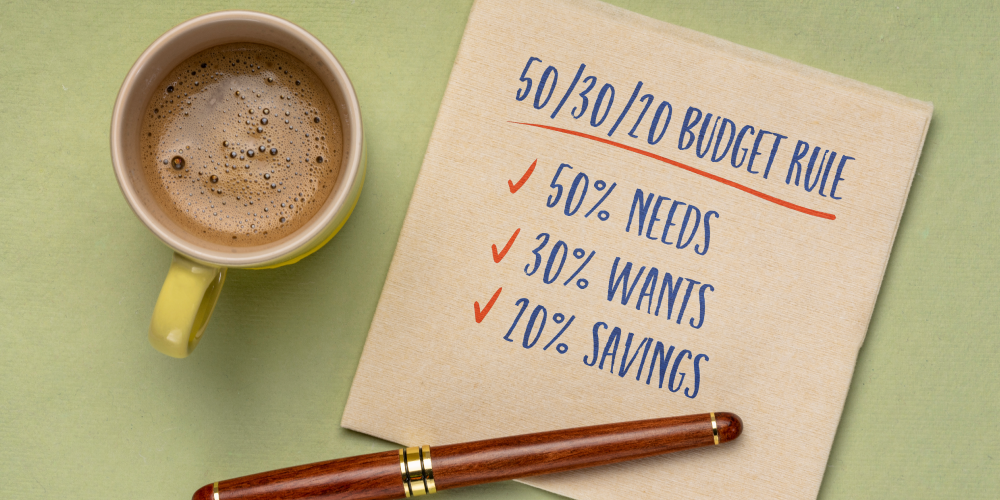

A Guide to the 50/30/20 Rule

The 50/30/20 rule is a popular and straightforward approach to budgeting that divides your monthly income into three main categories: 50% for needs, 30% for wants, and 20% for savings. This budgeting strategy can help you balance spending and saving in a way that’s easy to follow and adapt to your financial goals.

The biggest thing to keep in mind with this rule is that it’s a guideline, not a rigid requirement. Most people may not be able to save 20% of their income right away. That’s okay! You can start with a smaller percentage—say 5%—and gradually increase it over time. After six to 12 months, you might bump it up to 7.5%, and continue progressing until you reach the 20% benchmark.

It’s also worth noting that the 20% savings category includes various types of savings: emergency savings, regular savings, and retirement savings. The key is to build momentum and stay consistent as you work towards your financial goals.

Want to dive deeper into how the 50/30/20 rule works in real life? Be sure to tune in to our Friends and Finances podcast episode, where we break it down with practical tips and real-world examples.

If you’re a member of a credit union, implementing the 50/30/20 rule can be even easier. Credit unions typically offer flexible account options, lower fees, and personalized financial services, making them ideal for managing and maximizing your budget.

Here’s how you can use credit union accounts to streamline your 50/30/20 budgeting and set yourself up for financial success.

Step 1: Calculate Your Monthly Income and 50/30/20 Breakdown

Before setting up your accounts, start by calculating your monthly income after taxes. This is the amount you’ll divide according to the rule:

- Needs include essential expenses like:

- Housing

- Utilities

- Groceries

- Health insurance

- Transportation

- If you have debt payments like student loans or a car payment, include these here.

- Wants are non-essential but enjoyable expenses like:

- Dining out

- Entertainment

- Hobbies

- Shopping

- This category helps you enjoy your income responsibly without overspending on things that aren’t necessities.

- This portion goes toward building your savings and paying down debt. This includes:

- Emergency funds

- Retirement savings

- Any extra payments on credit card balances or loans beyond the minimum requirements.

For example, if your monthly income is $3,000:

- $1,500 (50%) for needs such as rent or mortgage, utilities, groceries, insurance, and transportation

- $900 (30%) for wants like dining out, streaming services, entertainment, travel, or shopping

- $600 (20%) for savings including emergency funds, retirement contributions, and extra debt payments

This simple breakdown helps you see exactly where your money should go each month, making it easier to plan, track spending, and adjust as needed.

Step 2: Set Up Designated Credit Union Accounts

To make managing these categories simple, consider setting up separate accounts with your credit union.

- Use a primary checking account for your essential monthly expenses. This is where you can deposit your paycheck or automatic deposits, and from here, you’ll pay for necessary bills like rent, utilities, and loan payments. Most credit unions offer accounts with minimal fees, so you can manage your needs without unnecessary costs eating into your budget.

- Pay yourself first! Consider setting up an automatic transfer so a portion of each paycheck goes directly into this account. Credit unions are known for offering competitive interest rates on savings accounts, often better than those of traditional banks. Use a designated savings account for emergency funds, vacation savings, or other long-term goals.

Step 3: Automate Transfers Between Accounts

Automating your transfers can help you stick to your 50/30/20 budget without much effort. Most credit unions allow you to set up automatic transfers, which means each month (or with each paycheck), your income can be divided among your needs, wants, and savings accounts.

For example:

- Each paycheck is deposited into your primary checking account

- An automatic transfer moves 20% into your savings account for emergency funds and long-term goals

- A set amount is transferred to a separate account for discretionary spending, helping you manage your wants

- The remaining balance stays in your main checking account to cover monthly bills and essential expenses

By automating these transfers, you reduce the temptation to overspend and make saving a consistent habit without having to think about it each month.

Step 4: Monitor and Adjust Your Spending

With separate accounts for each spending category, you’ll be able to track how well you’re sticking to your budget. Regularly monitoring each account is key to staying on track and understanding where you may need to adjust.

- Take advantage of your credit union’s online and mobile banking options to keep an eye on your accounts anytime, anywhere. Many credit unions also offer budgeting tools within their online banking platforms to help you categorize transactions and see spending patterns at a glance.

- Setting up mobile alerts can help you stay aware of your balance in each account. For instance, you could set an alert for your “wants” account to notify you when you’re close to your spending limit for the month.

- It’s a good idea to review your 50/30/20 budget quarterly to ensure it’s still meeting your needs. Life changes, such as a pay raise or moving, may require adjustments to your budget, and periodic check-ins will help you stay flexible and responsive.

Step 5: Use Credit Union Financial Resources for Support

Credit unions often provide personalized financial guidance and tools to help their members manage money. Here’s how you can leverage these resources:

- Many credit unions offer financial wellness workshops or tools that can help you make the most of the 50/30/20 rule. These might include one-on-one financial counseling, budget calculators, or educational seminars.

- Credit union advisors can provide insights on how to balance savings with debt repayment or maximize returns on your savings. They can help you create a debt repayment plan if the debt is a significant part of your budget.

- Some credit unions offer unique savings accounts, like holiday clubs or high-yield savings options. These accounts can be great places to put your 20% savings or build an emergency fund, helping you grow your funds with better interest rates than typical savings accounts.

Final Thoughts

???????

The 50/30/20 rule is a flexible, balanced approach to budgeting that can be even more effective when combined with the personalized services and low-cost account options that a credit union offers. By separating your needs, wants, and savings into designated accounts, automating transfers, and leveraging the financial resources available at your credit union, you’ll be able to manage your budget confidently and work towards your financial goals.

« Return to "Blog" Go to main navigation