Business Accounts

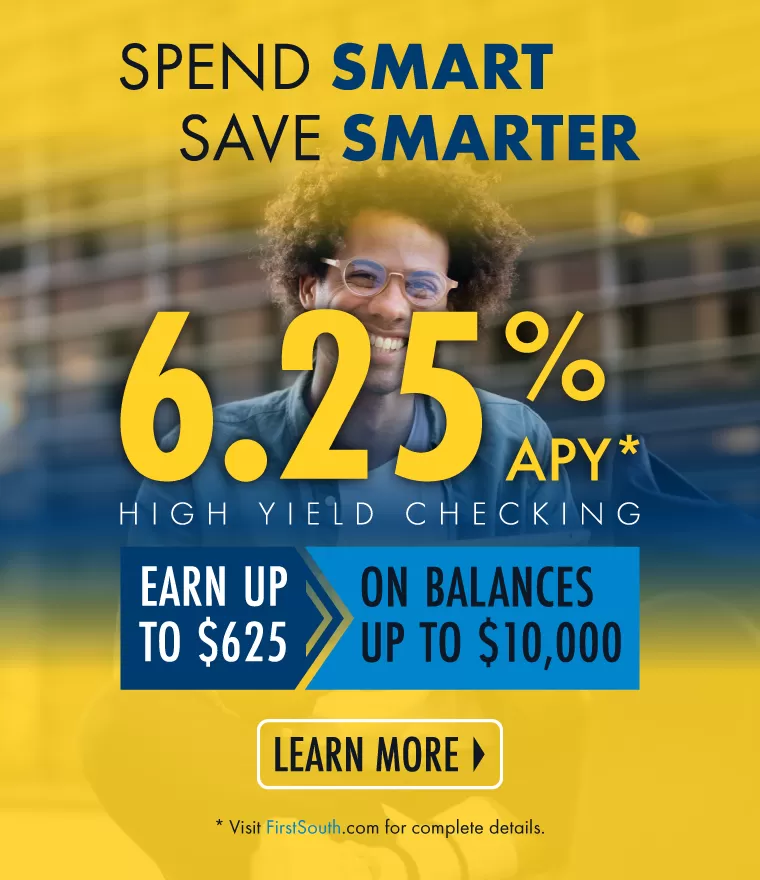

Deposit Account Options

We offer some of the best options for business accounts in the market today, such as:

- Business Savings

- Business Checking

- Business Money Market Accounts - Earn up to 3.75% APY*

To find out more, give us a call at 901-380-7400 today.

Business Bill Pay

With First South Financial's Business Bill Pay, you can begin paying your company’s bills the convenient way, online. This service will save you time and allow you to focus on growing and managing your business.

With our convenient Payment Center, you can:

- Review recent and pending payments

- View electronic versions of your bills

- Pay many billers the same or next business day

Click here to access your existing business bill pay account or to enroll in the service.

Now, you can securely pay all of your bills and manage important financial tasks from one convenient location. Once you are enrolled in the service you may either access it by clicking here or from within your personal online baking account.

*High Yield Money Market interest is based upon the current current market rates, and is compounded and paid monthly. The APY is an annualized rate that reflects estimated dividend earnings based on the dividend rate and frequency of compounding. A business checking account with First South Financial is required to earn the High-Yield rate. The annual percentage yield is accurate as of 12/23/2024 and may change monthly. Funds are available for transfer/withdrawal, 7+ transfers/withdrawals per month will incur a charge of $5.00 per instance. Accounts that fall below the minimum balance requirement of $25,000 will incur a $15.00 monthly service fee. Federally insured by NCUA. Offer subject to change or withdrawal without notice. Please see us for complete details.

Go to main navigation